Exploring the Power of Precious Metals in Modern Investment

Precious metals derive their value from rarity, business demand, and ancient significance. Unlike currencies that can be revealed or manipulated, metals like silver and gold keep intrinsic well worth.

Precious metals have continually held their area as stable belongings in the funding world. Their shortage and well-known appeal lead them to a reliable choice for the ones looking to diversify and defend wealth. For individuals learning methods to put money into silver, treasured metals provide a tangible opportunity to volatile paper assets. Gold, silver, platinum, and palladium aren't situation to the equal fluctuations as fiat currency, making them appealing during inflationary intervals. These metals provide both aesthetic and economic value, and investors cost their position in balancing and strengthening financial portfolios at some stage in financial uncertainties.

Understanding the Intrinsic Value of Precious Metals

Precious metals derive their value from rarity, business demand, and ancient significance. Unlike currencies that can be revealed or manipulated, metals like silver and gold keep intrinsic well worth. As buyers are seeking ways to put money into silver, they regularly explore its commercial programs, which increase its demand. Silver is used in electronics, solar panels, and scientific devices, including depth to its funding enchantment. Meanwhile, gold continues its function as a shop of value and wealth renovation asset. Together, they serve now not simplest as investment gear but also as realistic commodities with long-term relevance.

Physical Bullion: A Traditional Approach to Precious Metals

Investing in bodily bullionbars, cash, and roundsis one of the most direct ways to own treasured metals. Holding bodily silver or gold gives investors a feel of safety and ownership that virtual assets can't match. When researching methods to invest in silver, many begin with bullion due to its accessibility and transparency. Physical bullion can be saved at home or in steady vaults, imparting control and peace of thoughts. It's a preferred alternative for those looking to maintain tangible belongings outdoor the conventional banking system, in particular in times of financial instability.

Silvers Unique Role inside the Precious Metals Market

While gold frequently steals the highlight, silver gives a compelling opportunity with both investment and commercial price. Among the famous methods to put money into silver are shopping silver cash, bars, and trade-traded products. Silver's affordability as compared to gold permits buyers to accumulate more metallic for his or her investment, attractive to the ones building diverse portfolios. Additionally, silvers dual call forfrom both industries and buyersgives it a dynamic part. It can outperform other valuable metals all through technological advancements or financial recuperation levels, making it a flexible desire for growth and protection.

Precious Metals vs. Paper Assets: Risk and Reward

Unlike stocks or bonds that depend upon marketplace speculation and company performance, precious metals are grounded in real, finite sources. This difference makes them particularly attractive to investors in search of alternatives to paper property. While exploring approaches to put money into silver, many evaluate its performance with greater conventional investments. Metals like silver and gold are proof against financial ruin risks or poor control decisions, imparting a layer of safety in turbulent markets. They won't offer dividends, however they serve as a hedge and coverage against economic device volatility.

Digital Platforms for Buying Precious Metals

Digital era has simplified the system of obtaining valuable metals. Investors can now purchase silver or gold via on-line platforms supplying diverse investment merchandise. These consist of fractional ownership, vault storage, and real-time pricing. Exploring virtual methods to invest in silver facilitates present day investors get right of entry to international markets from the comfort of their homes. Digital platforms additionally decorate transparency, safety, and convenience. For new investors, these structures decrease the limitations to access and provide instructional sources to make knowledgeable choices.

ETFs and Mutual Funds in Precious Metals Investing

Exchange-traded funds (ETFs) and mutual funds offer oblique exposure to precious metals without proudly owning bodily assets. These economic units regularly song the rate of silver or gold and are traded like stocks. One of the most handy ways to spend money on silver, ETFs permit liquidity and simplicity of entry into the precious metals marketplace. They are ideal for investors looking for diversification and expert fund control. However, they come with dangers including counterparty exposure and shortage of bodily redemption, which investors ought to examine.

Silver Mining Stocks as a Growth-Focused Option

Investing in silver mining groups offers an opportunity technique to cashing in on growing silver costs. These stocks can outperform the underlying metal during bull markets due to their leveraged publicity. For those thinking about approaches to spend money on silver with higher go back potential, mining equities present a greater speculative however worthwhile direction. Investors must studies corporation fundamentals, production expenses, and geopolitical dangers. While extra unstable, silver mining stocks can enhance a different metals portfolio for increase-orientated buyers.

Precious Metals IRAs for Long-Term Wealth Planning

Self-directed IRAs permit people to encompass treasured metals in retirement portfolios. Silver and gold IRAs are famous with the ones looking to protect their retirement savings from inflation and market crashes. As human beings look for approaches to put money into silver for the lengthy haul, valuable metals IRAs offer tax-advantaged solutions. These debts are concern to IRS rules, along with garage necessities and authorized custodians, but offer an effective hedge inside a retirement making plans framework. They integrate the benefits of lengthy-term financial savings with the stableness of actual property.

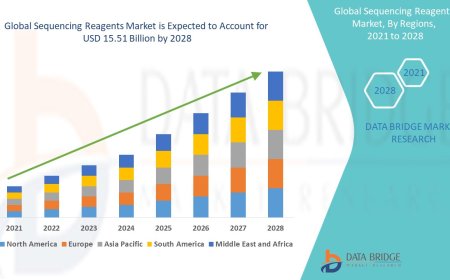

Demand Trends Shaping the Future of Precious Metals

Industrial packages, inexperienced energy initiatives, and emerging technology are boosting worldwide call for for treasured metals. Silver, particularly, is seeing accelerated use in electronics, car production, and renewable power. These evolving tendencies gift sparkling possibilities for the ones evaluating ways to spend money on silver. The demand landscape helps lengthy-term fee stability and boom capacity. Monitoring worldwide deliver chains and industry developments can offer treasured insights for investors searching for to capitalize on destiny trends inside the precious metals area.

Evaluating Precious Metals Dealers for Secure Purchases

Choosing a good supplier is important when acquiring valuable metals. Investors need to verify credentials, customer reviews, and transparency in pricing. Whether purchasing online or offline, credibility is prime to ensuring product authenticity and transaction protection. Among numerous ways to invest in silver, handling trusted dealers is fundamental. Look for clear records approximately product purity, garage alternatives, and purchase-returned rules. Secure packaging, third-celebration audits, and insured delivery are additional signs of supplier reliability and professionalism.

Storing Silver and Gold Safely: Tips for Investors

Proper storage ensures that your investment in valuable metals stays covered. Home safes, financial institution safety deposit containers, and professional vaults are common selections. When exploring methods to invest in silver, do not forget wherein and how it will likely be saved. The fee of these metals makes them a goal for robbery or harm, necessitating secure and insured environments. Vault storage solutions regularly consist of coverage, auditing, and easy resale options, making them a favored option for critical traders who prioritize both protection and liquidity.

Economic Indicators That Affect Precious Metals Prices

Interest rates, inflation records, and foreign money movements all influence the charge of valuable metals. Understanding these elements facilitates investors time their purchases and screen value tendencies. As you assess methods to invest in silver, it is beneficial to observe primary financial institution rules and macroeconomic shifts. Precious metals generally perform well while fiat currencies weaken or inflation rises. Investors who music market alerts could make knowledgeable selections, enhancing the strategic placement of silver and gold of their portfolios.

Precious Metals and Global Market Volatility

Geopolitical unrest, exchange tensions, and economic crises often pressure up call for for valuable metals. Their secure-haven fame turns into extra attractive when international markets become unpredictable. Those exploring methods to spend money on silver locate reassurance in its capacity to keep fee at some point of turbulent times. Precious metals offer a financial cushion that enables offset losses from other volatile investments. As uncertainty becomes a consistent topic in worldwide affairs, having silver or gold on your portfolio gives a far-needed layer of safety.

Building Generational Wealth with Precious Metals

Precious metals arent just quick-term hedgestheyre lengthy-time period legacy property. Passed down thru generations, silver and gold maintain price, offer liquidity, and convey historical importance. Among the numerous approaches to spend money on silver, growing a circle of relatives reserve is each financially and symbolically meaningful. These metals stand as enduring representations of difficult work, stability, and foresight. They can be stored securely, brought to trusts, or talented as part of an estate plan, contributing to generational wealth that transcends monetary cycles.

Conclusion: Precious Metals A Strategic Asset in a Changing World

In an era of economic fluctuations and digital uncertainties, precious metals preserve to offer safety, resilience, and lasting cost. Whether youre exploring ways to invest in silver or seeking to expand your financial portfolio, these tangible assets provide a reliable direction ahead. Silvers business relevance and affordability make it a compelling entry point, while gold continues to function a hedge in opposition to inflation and instability. As part of a assorted method, precious metals supply each performance and peace of thoughts. When youre geared up to make a pass in the direction of securing your future with depended on steerage and advanced carrier, flip to US Precious Metalsyour accomplice in treasured metals funding.